There are deductions associated with business travel but the IRS distinguishes between business and pleasure. Make sure your provincialterritorial vaccination schedule is up-to-date.

Travel Medical Insurance Is Tax Deductible Medi Quote

You will need a WHO Yellow Vaccination Passport if you plan on traveling internationally once borders open.

Are travel vaccines tax deductible. Review your immunization history. You can deduct your travel expenses including travel lodging and meals for yourself when you attend a convention within the United States if you can show that attending the convention benefits your business. News Coronavirus Joe Biden Tax Credits IRS Some small businesses and non-profit organizations can claim a paid leave tax credit to fully offset the costs of providing paid sick leave.

The CDC in mid-May quietly changed its international travel recommendations to require fully vaccinated people to test negative for COVID-19 before flying to the United States. If the taxpayer travels outside the United States expenses for travel can be deducted if the trip is entirely for business purposes. How to claim employee travel expenses.

Theres a proposal in Congress to give you an Explore America tax credit of 4000 or more to cover travel expenses. However our current understanding of virus transmission following vaccination and the duration of immunity following vaccination is still limited. These rules apply to workshops conferences and seminars as well as actual conventions.

In order to deduct the travel. If your employees travel for your business the business must actually pay for the travel expense to be able to claim it as a deduction. Paying directly for the expense from the business account.

If you take the family on a trip and meet with a client for dinner one night the dinner with the client is deductible. However exceptions do exist. Example EIM34004 Travelling expenses.

They are RARELY deductible. Any work assignment in excess of one year is considered indefinite. The medical services had to be for you or a member of your household and must not have been available where you lived.

When travelling outside Canada you may be at risk for a number of vaccine preventable illnesses. The business can pay for the expense by. If you buy a comprehensive travel insurance policy you may only deduct the portion of the policys premium related to travel medical insurance.

Right now things like meals and entertainment expenses for businesses are non-tax deductible. Not only that but all travel expenses are deductible in that case. You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home.

While you may conduct business in your town only your standard mileage rate and meals assuming you dine with business contacts are deductible. Vaccinations are private in nature. This is an opportunity to.

Expenses that may be deducted. You should consult a health care provider or visit a travel health clinic preferably six weeks before you travel. If not you risk having the deduction disallowed in an audit.

However you cant deduct travel expenses paid in connection with an indefinite work assignment. Certainly not for vaccinations available to the general public. Convention expenses may be deductible.

Travel Medical Insurance Whether you are traveling for medical procedures business purposes or just entertainment you may write off the cost of your travel medical insurance premiums. COVID-19 vaccines approved for use in Canada are highly effective at preventing illness. Will Uncle Sam Pay You to Take a Vacation.

For tax years after 2017 generally entertainment expenses are no longer deductible. The Government of Canada is reviewing the scientific evidence as it becomes available. Travel Tax Credit.

You cant however rent a hotel room within a reasonable distance of your home even if youd spent the day at a conference at a nearby hotel and expect to write it off. You can claim a deduction for medical travel if you have an amount in box 33 of your T4 slip or box 116 of your T4A slip showing any taxable travel benefits you received in the year. However its a different story if the trip is not entirely for business purposes.

Pin On Work Related Infographics Maps

Tennessee Sales Tax Small Business Guide How To Start An Llc

Pin By Ds On Nursing Nursing Students Quotes For Students Super Powers

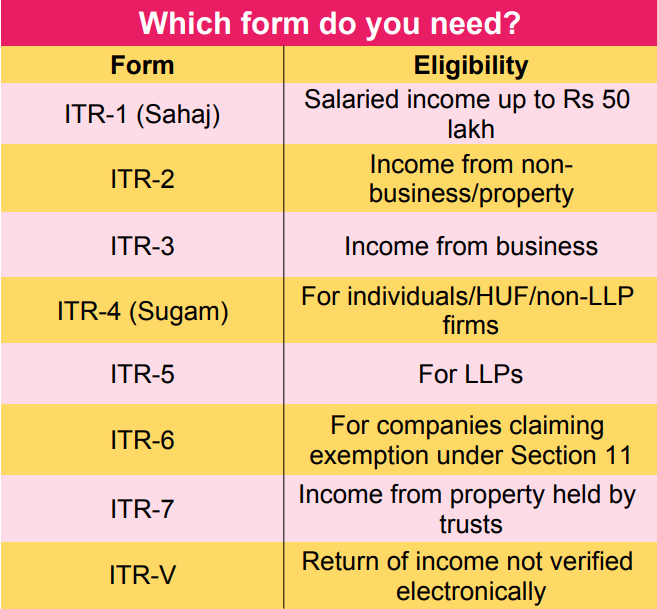

So What Form Do You Need For Your Income Tax Returns This Year Times Of India

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Tax Deductible Products Vhis Qdap Tvc Manulife Hk

As Recently The Central Board Of Direct Tax Cbdt Mentions All Conditions For Pension Funds Availed It Exemptions That S In 2020 Pension Fund Tax Software Income Tax

Your Child Care Payments Could Get You Up To 16 000 In Credits Everything To Know Cnet

Useful Guide To French Wealth Tax The Good Life France

Surgery Consent Forms Templates Consent Forms Templates Consent

I Am Being Offered A Full Time Salaried Position W No Health Insurance If I Get An Health Ins Affordable Health Insurance Life Insurance Policy Compare Quotes

Us Expat Tax Advice Do I Have To Pay Us Taxes As An Expat Expat Tax Expat Business And Economics

Special Personal Income Tax Relief Up To Rm 1 000 For Domestic Travels Sunway Travel Sdn Bhd

Fact Check False Claim That Checkout Charities Offset Corporate Taxes

Ultimate Life Planner Printable Planner Bundle Life Planner Etsy Finance Planner Planner Bundle Printable Planner

0 comments