Find current rates in the continental United States CONUS Rates by searching below with city and state or ZIP code or by clicking on the map or use the new Per Diem tool to calculate trip allowances. Your employees can also use.

What Can Independent Contractors Deduct

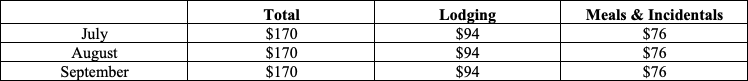

The standard per diem rate in effect from Oct 1 2018 to Sep 31 2019 for travel within the continental US is 195 total accommodation meals and incidentals.

Average per diem for business travel 2018. And on the first and last days of travel the per diem rate for meals and incidentals MIEs is 75 of the full-day amount. 30 2018 travel the high-cost-area per diem is 287 up from 284 consisting of 216 for lodging and 71 for MIE. The standard per diem rate in effect from Oct.

In the business world a per diem payment is a daily allowance for travel expenses. Per-diems are fixed amounts to be used for lodging meals and incidental expenses when traveling on official business. For CONUS destinations the per diem rate for lodging excludes taxes.

501 Changes in high-low per-diem localities. The new rate will go into effect on Oct. 1 2018 to Sept.

Corporate Travel Index 2018 - Per diem rates for the United States and around the world. 50 rows FY 2018 Per Diem Rates apply from October 2017 - September 2018. 57 for meals and 134 for.

Incidental per diem traveling expenses. The food and incidentals per diem rate for Denver Colorado is set at 69 dollars for 2018 while the rate in Colorado Springs Colorado is 59 dollars. IRS issues 20182019 per-diem rates.

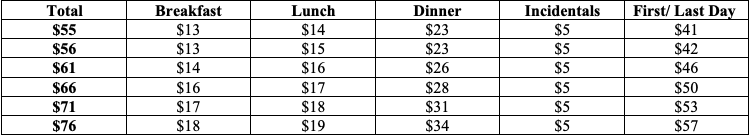

Federal per diem rates are set by the General Services Administration GSA and are used by all government employees as well as many private-sector employees who travel for their companies. As of this articles publication the per diem rates in 20182019 averaged around 55 per day for breakfast lunch and dinner. Per diem is a Latin phrase that means per day or for the day.

Number Per-Diem Destinations Average Meals. While per diem looks like a complicated concept its relatively simple. In this even simpler system the IRS sets a flat rate of per diems for areas identified as high-cost and applies a second set of low-cost per diems to all other areas.

Under the optional high-low method for post-Sept. The low-cost per diem is 191. Taxpayers are not required to use a method described in this revenue procedure and may instead substantiate actual allowable expenses provided they maintain adequate.

The per diem rates get updated every year usually on October 1 with the beginning of the US. 68 for meals and 216 for lodging. Revenue Procedure 2019-48 PDF posted today on IRSgov updates the rules for using per diem rates to substantiate the amount of ordinary and necessary business expenses paid or incurred while traveling away from home.

This daily rate covers lodging meals and incidental expenses also known as MIE. As of October 1 2018 the special meals and incidental expenses MIE per diem rates for taxpayers in the transportation industry are 66 for any locality of travel in the continental United. These expenses could be for lodging meals tips taxi and other ground transportation fees.

The per-diem for all other localities is 195 up from 191 consisting of 135 for lodging and 60 for MIE. The IRS on Wednesday provided. Per Diem Rates Rates are set by fiscal year effective October 1 each year.

How per diems work for travel expenses Per diem rates are fixed location-specific amounts to compensate for travel expenses such as accommodation meals and incidental expenses. The final column on GSA tables lists the rate for food and incidental expenditures as a single rate. The new rates are in effect from Oct.

31 2019 for travel within the continental US is 195 total accommodation meals and incidentals. Per diem is Latin for per day or for each day. It includes 93 for lodging which accounted for the 2 year-over-year increase and 51 for meals and incidental expenses.

In 2018 the high-cost per diem is 284. Food Allowance Per Day By Geography davidsimonphotoiStockGetty Images. Business travelers who incur expenses while traveling away from home have new per-diem rates to use in substantiating certain of those expenses Notice 2018-77.

The General Services Administration per diem for fiscal year 2018 will increase to 144 from 142. 1 2018 to Sept. While per diem has several meanings in relation to Human Resources it is the daily allowance paid to employees for expenses incurred while traveling for business.

Https Www Interpol Int Content Download 15997 File Financial 20statements 202019 Pdf

Instructions For Form 2106 2020 Internal Revenue Service

Https Www Interpol Int Content Download 15997 File Financial 20statements 202019 Pdf

The One Time Brand Name Of Diem Thong Nhat Is No Longer Burned Vnexplorer

Travel Policies For Sales Employees 30secondstofly Inc

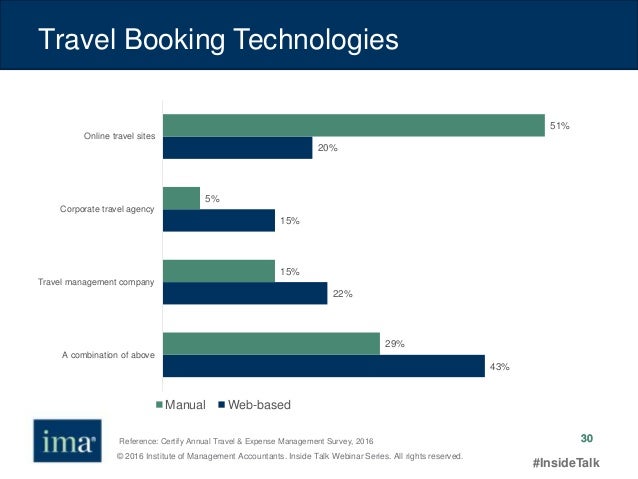

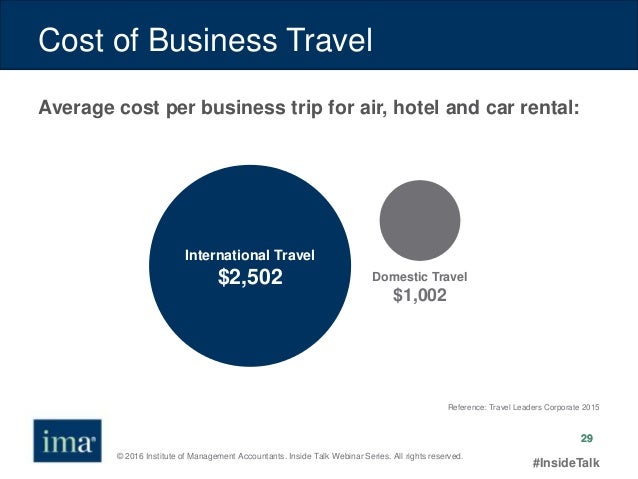

Expense Reporting Strategies Trends And Technologies For 2016

Business Travel Cities With The Highest Average Per Diems Us 2020 Statista

Business Travel Cities With The Highest Average Per Diems Us 2020 Statista

Expense Reporting Strategies Trends And Technologies For 2016

Https Www Interpol Int Content Download 15997 File Financial 20statements 202019 Pdf

Airbnb Hotel Demand Share Us Europe 2015 2020 Statista

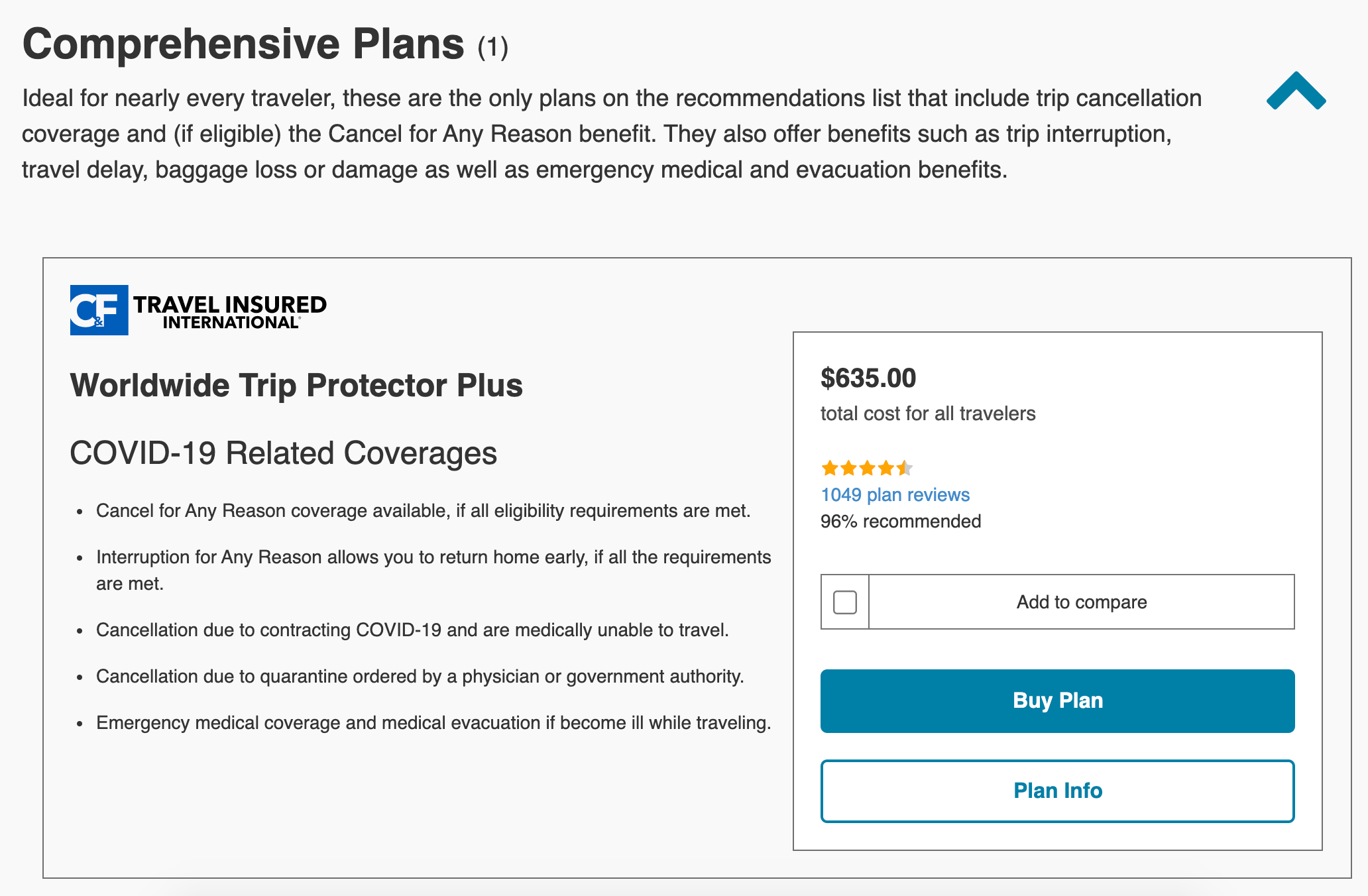

Tpg S Comprehensive Guide To Independent Travel Insurance Including Coronavirus Coverage

Per Diems For Dummies United States Rydoo

Visitors To The U S From India Statista

Unlocking The Strategic Value Of T E Expense Management

U S Adults That Took A Staycation 2020 Statista

Per Diems For Dummies United States Rydoo

Pdf Bleisure Motivations And Typologies

Does A Company Have To Pay Per Diem

0 comments